Form 941 Schedule B 2024 – You pay the federal employer taxes on a quarterly basis–March, June, September and December–and submit the payment with Internal Revenue Service Form 941. You can obtain a copy of the 941 Form . Please review the registration calendar to determine when the form is accepted. This form is provided for: Please select one of the following to proceed to the registration form. Active Login: I am a .

Form 941 Schedule B 2024

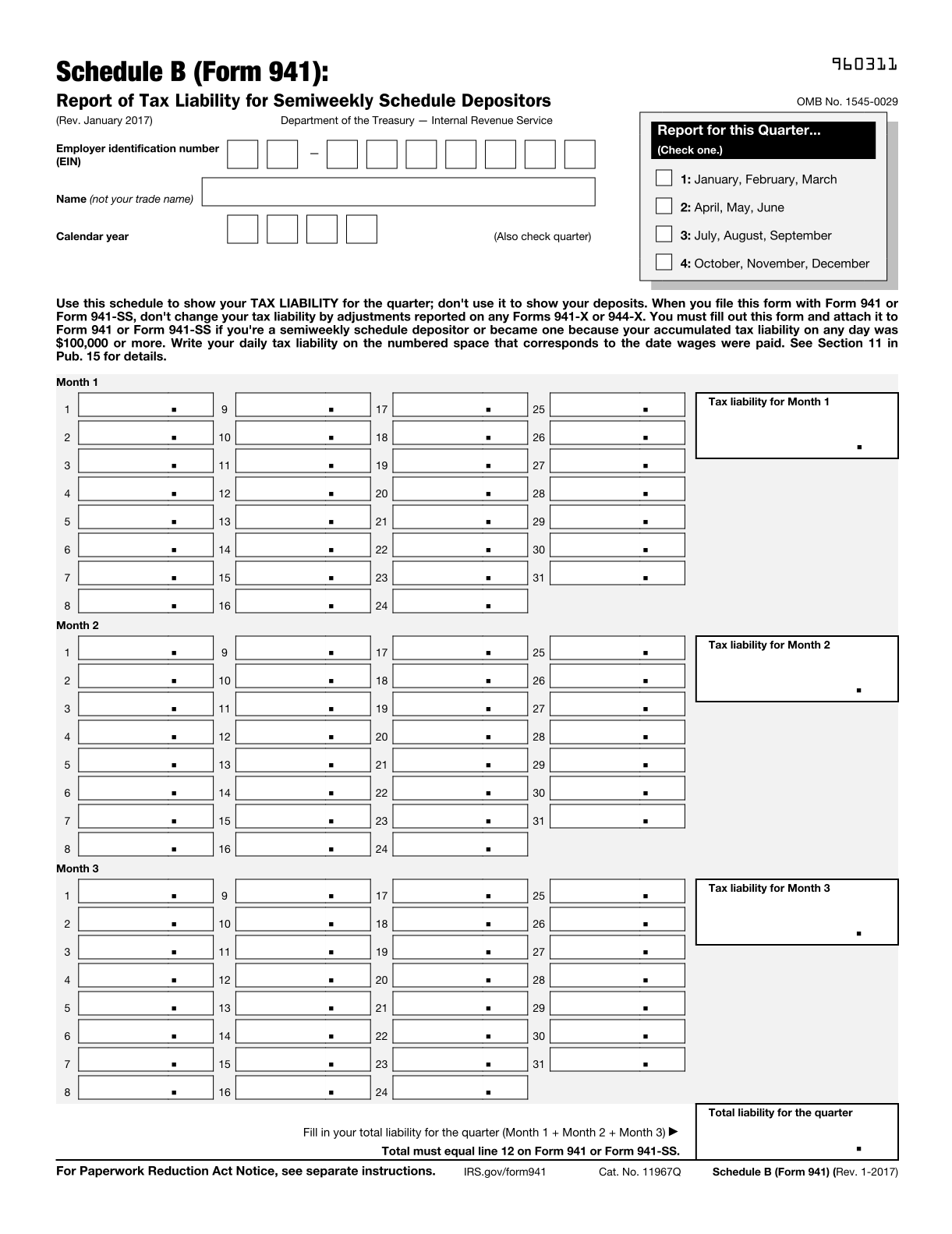

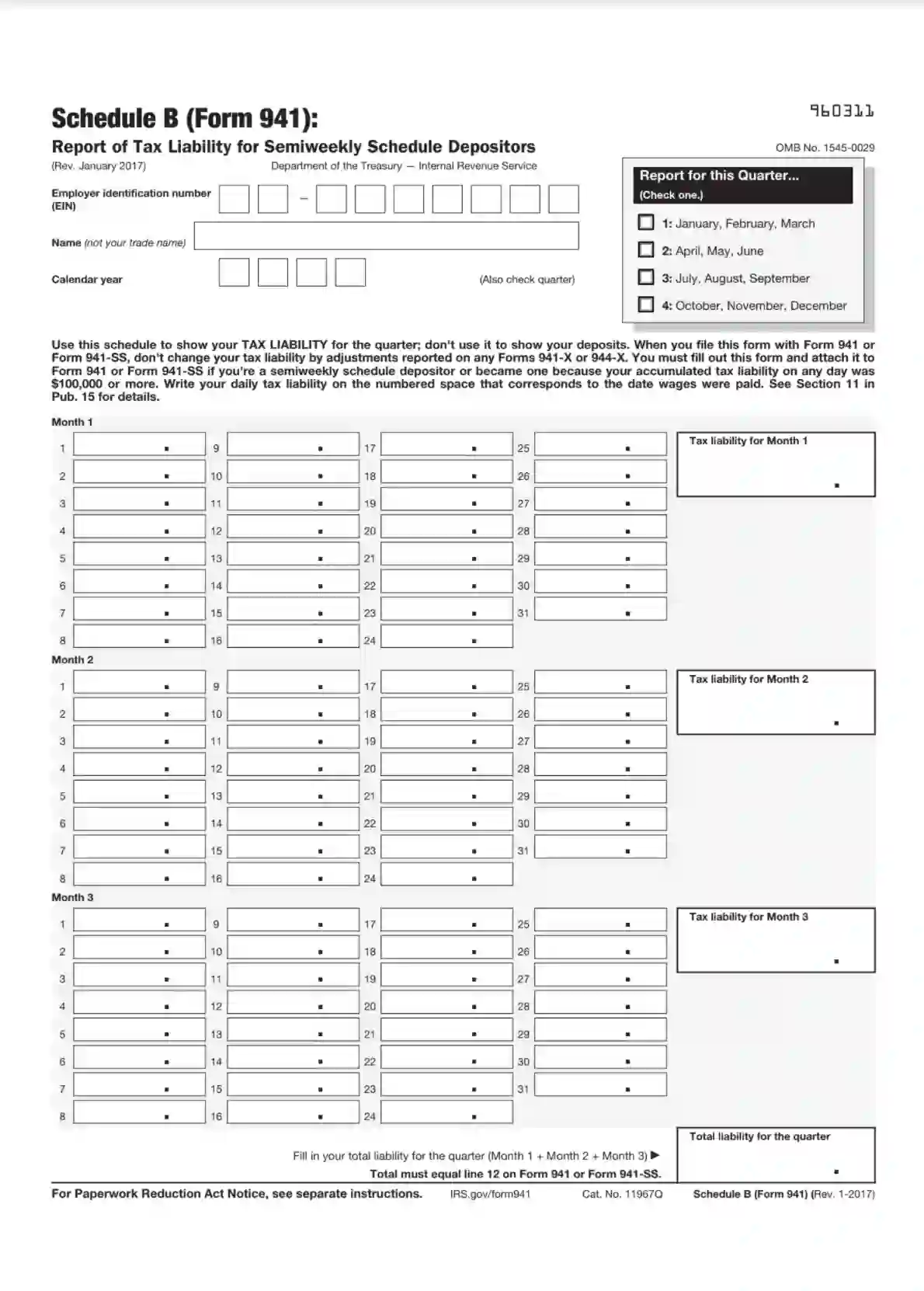

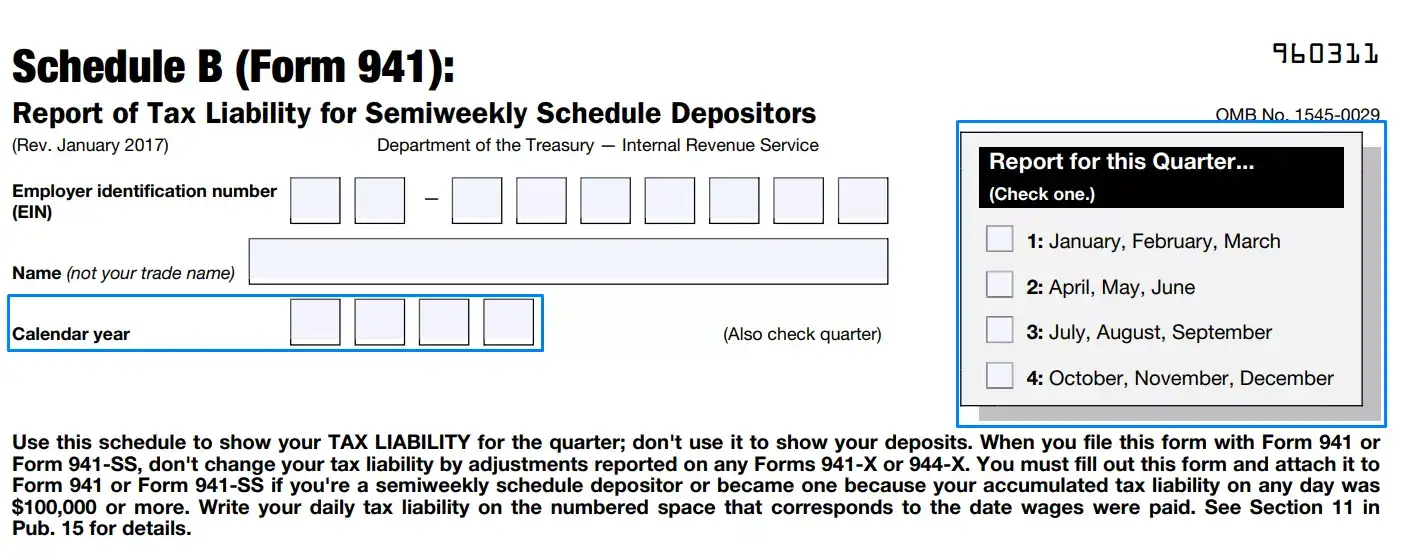

Source : form-941-schedule-b.pdffiller.comSchedule B (Form 941) (Report of Tax Liability for Semiweekly

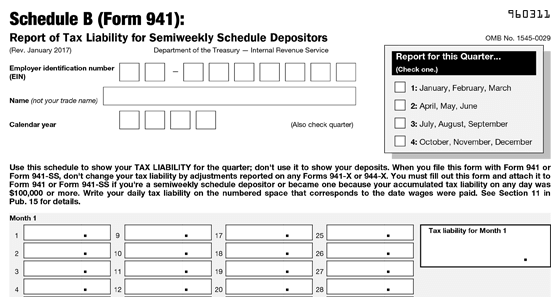

Source : hancock.inkIRS Schedule B Form 941 ≡ Fill Out Printable PDF Forms Online

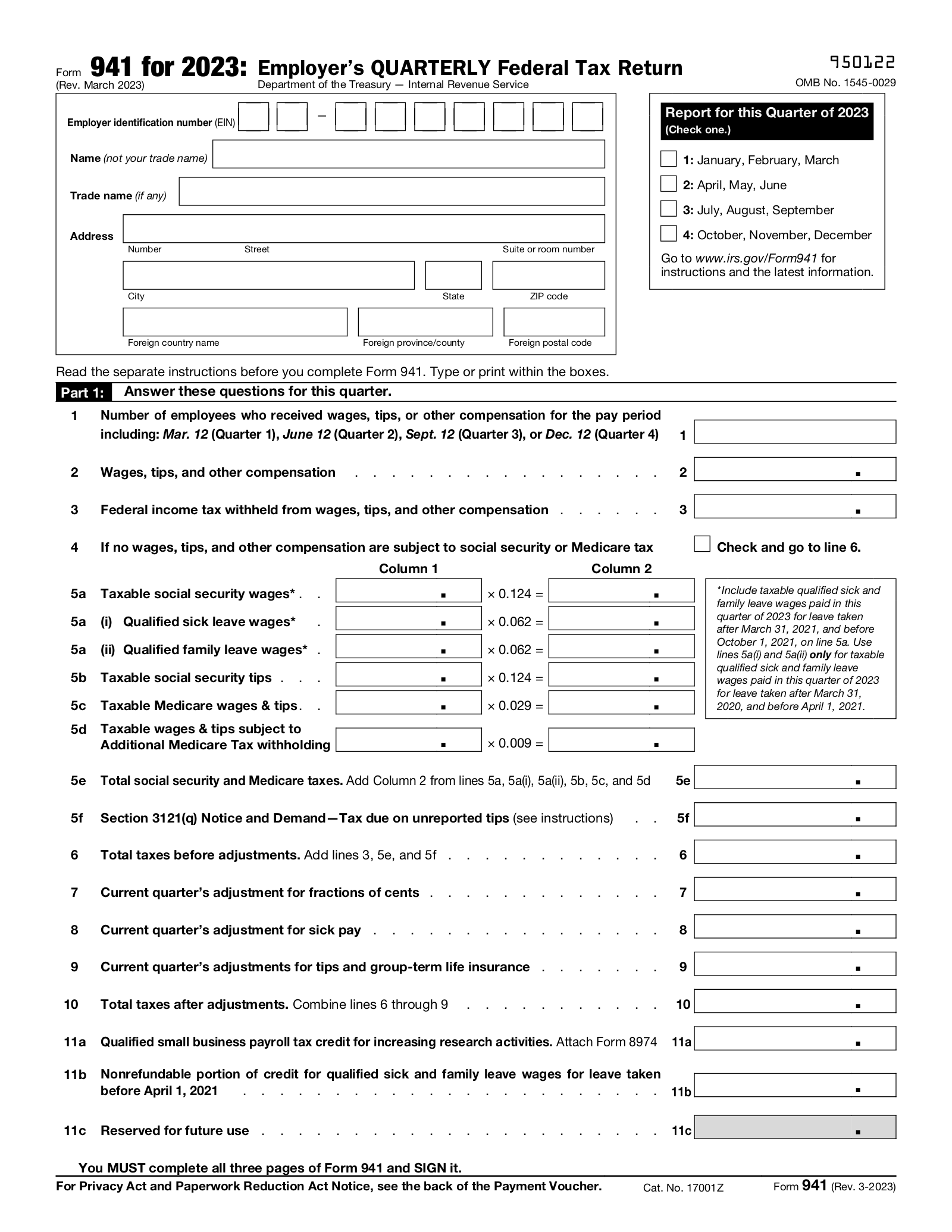

Source : formspal.comIRS Form 941 Schedule B for 2023 | 941 Schedule B Tax Form

Source : www.expressefile.comForm 941: Employer’s Quarterly Federal Tax Return – eForms

2017 2024 Form IRS 941 Schedule B Fill Online, Printable

Source : form-941-schedule-b.pdffiller.comIRS Schedule B Form 941 ≡ Fill Out Printable PDF Forms Online

Source : formspal.comSemi Weekly Depositors and Filing Form 941 Schedule B | Blog

Source : blog.taxbandits.comIRS Schedule B Form 941 ≡ Fill Out Printable PDF Forms Online

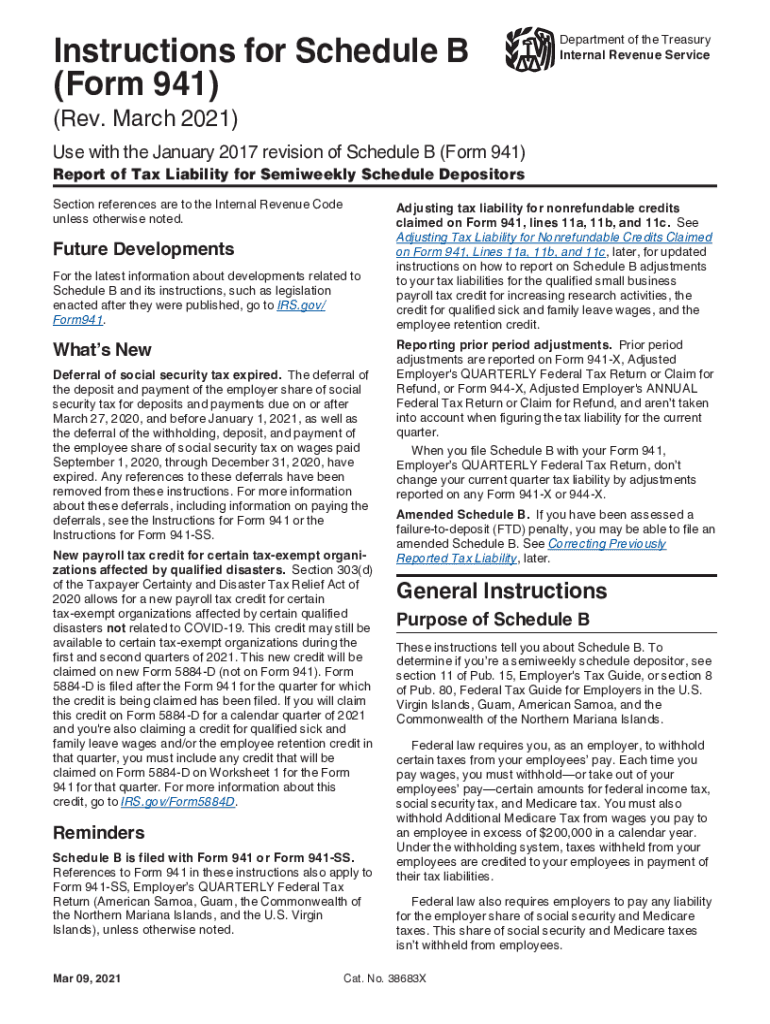

Source : formspal.comIrs instructions schedule b: Fill out & sign online | DocHub

Source : www.dochub.comForm 941 Schedule B 2024 2017 2024 Form IRS 941 Schedule B Fill Online, Printable : If you are having trouble filling out this form, please use the Firefox browser. Please note that items with an asterisk (*) are only available at limited locations . You pay capital gains taxes with your income tax return, typically using Schedule D. The data from Form 1099-B helps you fill out Schedule D and Form 8949 if needed. If you owned an asset .

]]>